The Development Budget Coordination Committee (DBCC), chaired by the Secretary of Budget and Management, recently issued the Fiscal Year (FY) 2018 Mid-Year Report to provide updates on the performance of the Philippine economy. The report discusses the 2018 National Government Budget, the first semester macroeconomic and fiscal performance of the Philippine economy, as well as the economic outlook for the rest of the year.

The DBCC’s mid-year report highlighted reforms on the fiscal sector, particularly the Tax Reform for Acceleration and Inclusion (TRAIN) on the revenue front and the shift to cash-based budgeting on the spending side. These are vital measures that will enable the government to finance and realize its socio-economic objectives.

“Such landmark fiscal reforms have enabled the Philippine economy to register better-than-expected performance in terms of revenue collection, public spending, and the deficit,” said Budget and Management Secretary Benjamin E. Diokno. “This is backed by the numbers—revenues and disbursements are above program, while the deficit is below-target. This positive confluence of factors does not happen often, if at all,” the Budget Chief added.

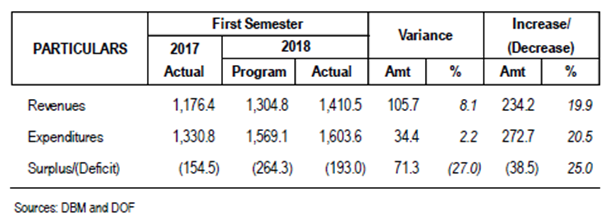

From January to June 2018, actual revenue collections of the government have reached PhP1.411 trillion, higher by PhP105.7 billion or 8.1% than the PhP1.305 trillion program. This is on account of tax policy reforms under TRAIN, tax administration improvements in the Bureau of Internal Revenue (BIR) and the Bureau of Customs (BOC), as well as higher non-tax revenues from income collected by the Bureau of Treasury (BTr) and privatization proceeds.

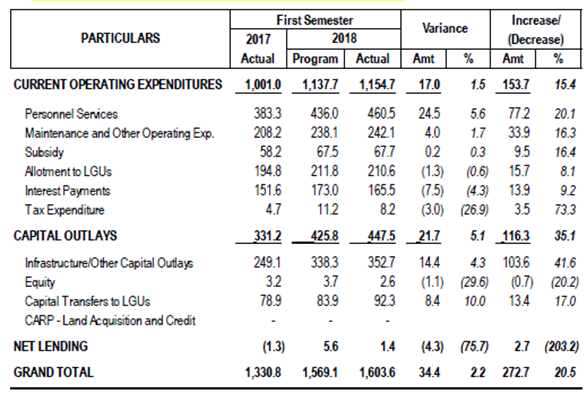

Meanwhile, spending in the same period has reached P1.604 trillion, up by PhP34.4 billion or 2.2% compared to the PhP1.569 trillion program. The faster utilization of funds means that the people will enjoy the benefits of government programs and projects at the soonest possible time. It means more prompt completion of public infrastructure projects, such as roads, bridges, and mass transit systems, and more efficient delivery of social services, like education, healthcare, and poverty-alleviation programs.

The improvement is credited to the early release of funds with the General Appropriations Act-As-An-Allotment-Order (GAAAO) Policy, the one-year validity of appropriations, and the transition to a cash-based budgeting system in 2019. In particular, infrastructure and other capital outlays have paced public spending with the government’s aggressive Build Build Build campaign.

Given the revenue and spending performance, the deficit registered at PhP193.0 billion in the first half of 2018. This is PhP71.3 billion or 27.0% lower than the programmed deficit in the first semester set at P264.3 billion.

In terms of the macroeconomic environment, the DBCC noted that the Philippine economy grew by 6.3% in the first half of 2018. Though it is below the government’s target of 7.0% - 8.0%, the Philippines remains to be one of the fastest-growing economies in the region.

As a testament to the increasing role of government in promoting economic growth, government consumption grew by 12.6% in the first semester of the year, higher than the 4.3% growth rate posted by government consumption in the same period last year. Under capital formation, public construction also surged by 22.1% in the first half of 2018, up from the 9.3% growth in the first half of 2017. Again, this is due to robust government spending for priority programs and projects, particularly Build Build Build.

The infrastructure projects of the Department of Public Works and Highways (road projects, flood control projects, etc.) and other capital outlay projects of the Philippine National Police (construction of police stations), Department of Education and State Universities and Colleges (repair and rehabilitation of school facilities) contributed to the rise in public construction and infrastructure spending.

The DBCC will convene on October 16, 2018 to reassess its medium-term macroeconomic assumptions and review fiscal targets in light of recent economic developments, particularly inflation, the interest rate environment, and updates on tax reform in Congress.

The 2018 Mid-Year Report of the DBCC may be accessed through the following link in the DBM webpage: https://www.dbm.gov.ph/index.

(30)

TABLE 1: National Government Revenue Performance (in billion pesos)

TABLE 2: National Government Disbursement Performance (in billion pesos)

Table 3: National Government Fiscal Position (in billion pesos)

Table 4: Growth of GDP, by Component

For inquiries, further questions and requests for interview, please contact Marianne Ongjuco:

Email:Mobile: +63918-944-8109